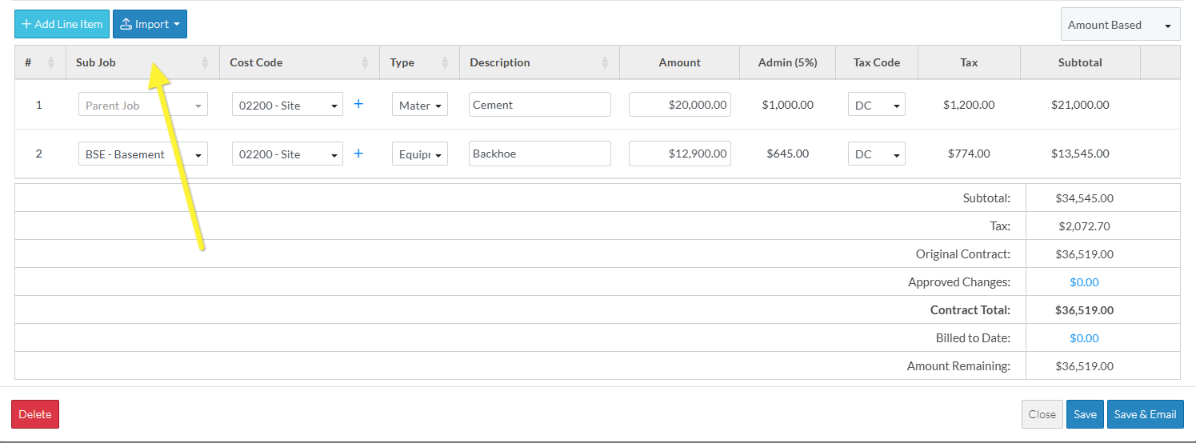

Schedule of Values - Line Items

Suggested Prior Reading

Schedule of Values – Layout and Navigation

Line Items on the Schedule of Values

The information that displays and is entered for Line Items on the Schedule of Values will vary depending on:

- Whether the Accounting Method is Amount Based or Unit Based, see Schedule of Values - Accounting Method.

- If Tax Codes have been setup, see Settings - Tax Codes.

- If Financial Markups have been applied, see Financial Markups.

- If Sub Jobs have been turned on for the project, see Sub Jobs - Overview.

Line Item #

The first column is always the Line Item number. This is automatically generated by the system and can not be changed.

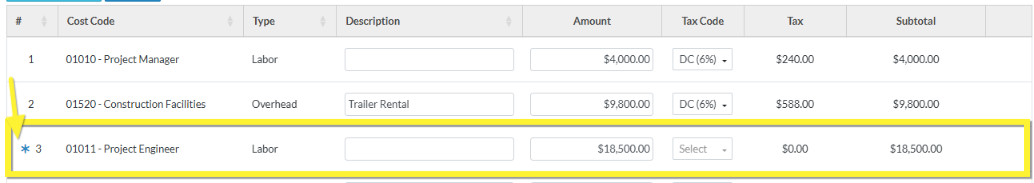

If the Schedule of Values is for a Change Order, there may be a blue asterisk next to the Line Item number to indicate that it was created from a Change Request. See Contract Change Requests - Overview for more details.

If the Schedule of Values has Financial Markups, and a Financial Markup has been set to Apply to Budget Code, the Line Item is automatically created for that Financial Markup. A blue up arrow appears appears to the left of the Line Item# to indicate that it was created from a Financial Markup and that Line Item can't be edited or deleted. See Financial Markup - Applies to Budget Code for more information.

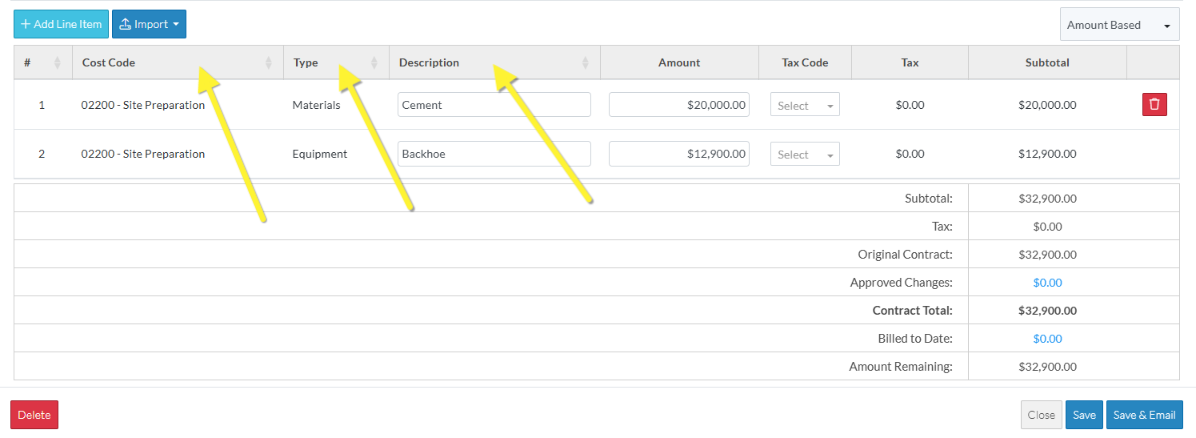

Cost Code, Cost Type and Description

There will always be the Cost Code, Cost Type and Description.

Cost Code and Cost Type are required fields and once the Schedule of Values is saved, they can not be changed (as they are connected to Budget information).

The Description is optional and can be changed (as long as the Status enables edits).

Accounting Method: Amount or Unit-Qty Based

How the Amounts are entered for Line Items depends on the Accounting Method set. See Schedule of Values - Accounting Method for more details.

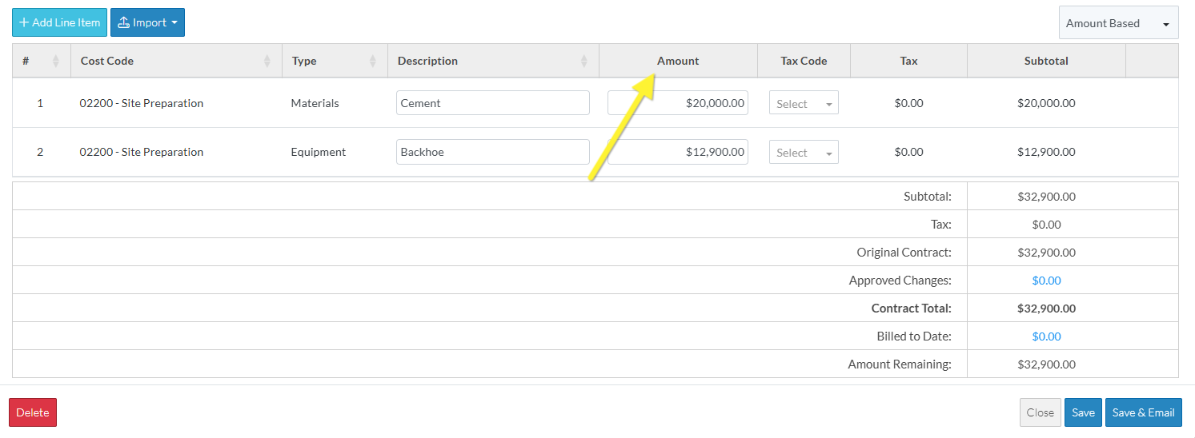

Amount Based

If the Accounting Method is set to Amount Based, the line items will have an Amount column. Enter the Amount of that line item (excluding taxes or Financial Markups).

The Subtotal of that Line Item is automatically set to the Amount (then adding any financial markups applicable).

Unit Quantity Based

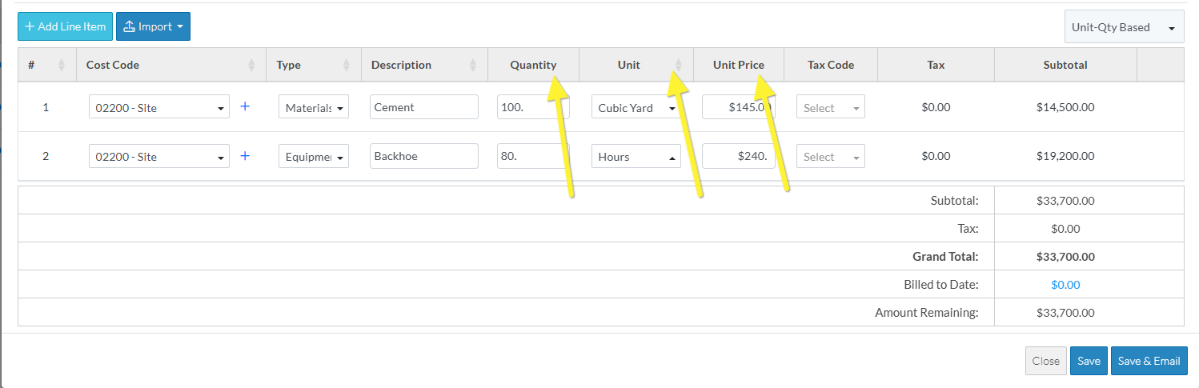

If the Accounting Method is set to Unit-Qty Based, the line items will have a

- Quantity

- Unit

- Unit Price

All three columns are required.

The Subtotal of that Line Item is automatically calculated by multiplying the Quantity x Unit x the Unit Price (then adding any financial markups applicable).

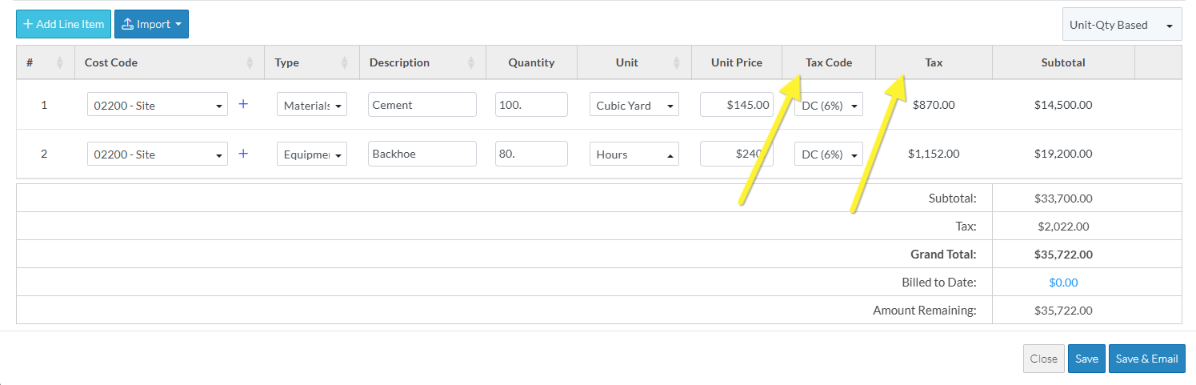

Tax Code and Tax

If Tax Codes have been setup, there will be a Tax Code drop down to choose the Tax Code to apply. Then there is also a Tax column that automatically displays the Tax amounts.

The Tax Amounts for each Line Item do not get added in the Line Item Subtotal. They are instead all added together and appear in the Summary and Total Sections in the Tax row.

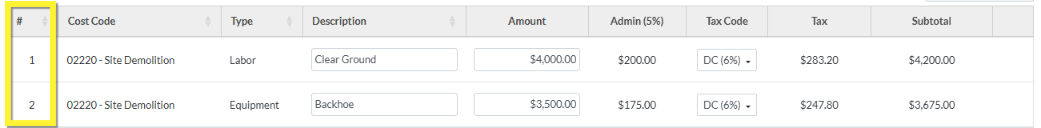

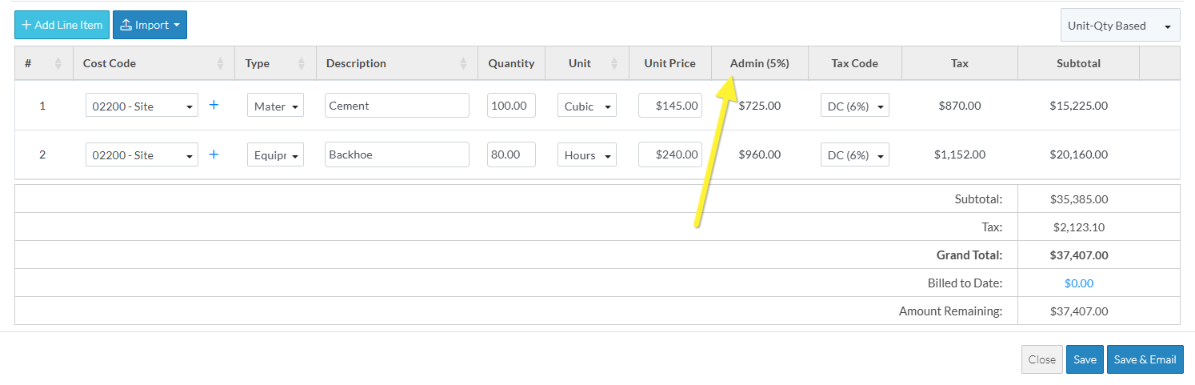

Financial Markups

If Financial Markups have been setup and configured to appear on each Line Item, there will be a column with the Financial Markup name and Markup Percentage and in the line item field, there will be the automatically calculated Markup amount.

Depending on the setting for Financial Markups, they may be added into the Line Item Subtotal or they do not get added in the Line Item Subtotal. They are instead all added together and appear in the Summary and Total Sections in a specific Financial Markup row.

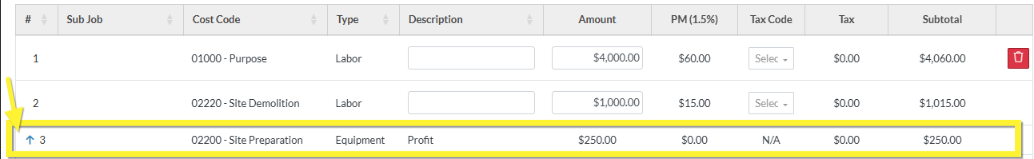

Sub Jobs

If Sub Jobs have been setup, a Sub Job column appears as the first column and is where either the Parent Job or the Sub Job is selected and displays.

Subtotal

Each line item has Subtotal. The values in the Subtotal depend on Financial Markups (if any) and their settings (see above for more information).

Next Steps

Set the Default Accounting Method for the Schedule of Values, see Schedule of Values - Accounting Method.

Add a Schedule of Values Line Item, see Schedule of Values - Add Line Item.

Bulk Import Schedule of Values Line Items, see Schedule of Values - Import.

Edit a Schedule of Values Line Item before the Line Item has been saved, see Schedule of Values - Edit Line Item.

Edit a Schedule of Values Line Item after the Line Item has been saved, see Schedule of Values - Edit Line Item.

Delete a Schedule of Values Line Item, see Schedule of Values - Delete Line Item.