Job Costing - Sales Tax

Management of sales taxes can be complex and varied between countries and could include multiple levels of taxes such as in the US (for states, counties, and even Cities) or federal plus provincial taxes (if in Canada).

The accounting system for the organization would track the details of the taxes from the accounting perspective and for formal tracking and reporting.

JobPlanner tracks taxes for forecasting and managing project costs and to generate contract documents. In addition, it can also support the accounting system functionality.

JobPlanner enables the association and calculation of taxes for each individual line item on a Schedule of Values.

Then tax values from JobPlanner would go into the accounting system (either manually reconciled/entered or via integration) and the accounting system is where the total tax burden is tracked across projects.

JobPlanner has functionality to support simple or complex tax management scenarios.

If customers have an integration to the ERP/Accounting systems, then how taxes are tracked in JobPlanner would be dependent on the ERP/Accounting system setup.

The following is a summary of the tax features in JobPlanner, with some examples of where/when they might be used. This is for reference only and each organization will have to review their tax requirements.

Tax functionality in JobPlanner

JobPlanner has two main components that can be used to manage taxes:

- A global list of Tax Codes and percentages

- Taxes applied by Cost Code

A global list of Tax Codes and percentages

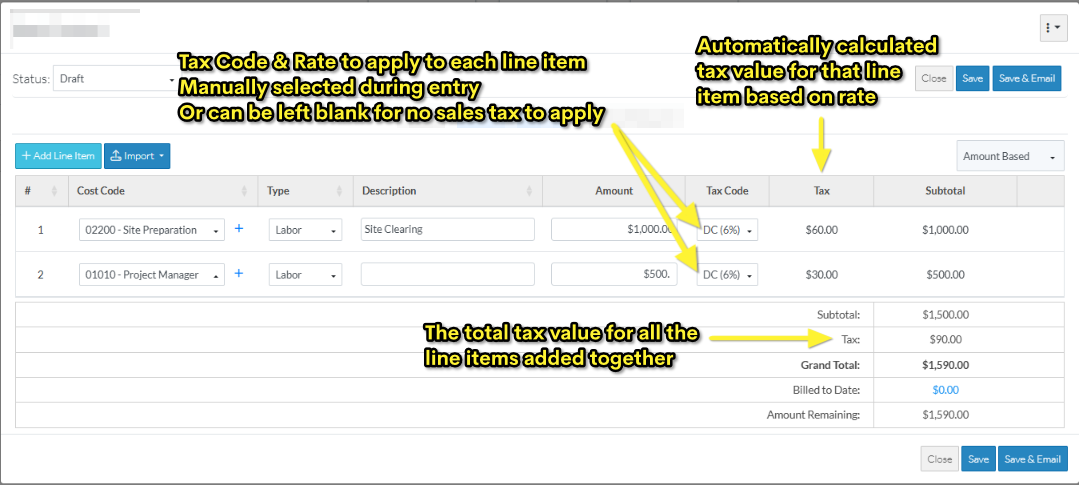

A list of tax codes and their tax percentage can be maintained in a central tax code and rate (percentage) list.

Then during the creation (or revision if applicable) of a line item on the Schedule of Values, a tax code from the global list of tax codes can be selected and applied to that line item.

- Each individual line item can have a different tax code from the global list applied

- But only one code from the global list can be applied to a line item

The Tax amount for that line item is automatically calculated. It is then displayed in two places:

- On the line item in the Tax amount column (but it is not included in the line item Subtotal column. Its a separate amount for the line item).

- In the tax total for the entire schedule of values, the Tax amounts for ALL line items are added up.

- This is added to the Subtotal of all line items (without tax) to create a Grand Total.

In the US, accounting systems will usually have tax codes that are setup by a region i.e. a region is comprised of a State, County and optionally City, and are comprised of separate percentages, which then add up to a total percentage (i.e. a percentage for the State, a percentage for the County and a percentage for the City are added up to create a total rate).

This is so they pay the right amounts to each "region". The Accounting system would manage the separate percentages that make up the region total tax rate (i.e. tax rate for the State, tax rate for the County, tax rate for the City). JobPlanner would just have the region total tax rate (but this is a total rate not the breakdown by State, County, City etc).

In this scenario, if there is an integration to the ERP/Accounting System,

- JobPlanner pulls these tax codes and total percentage from the ERP/Accounting System into the Global Tax list

- JobPlanner pushes the Amount (without tax) and the Tax Code to the ERP/Accounting System (not the rate, just the code). The ERP system uses the Amount and the Code and then separately calculates the tax for each line to ensure it is accounted for in the General Ledger as a tax amount and as separate tax values by State, County, City if applicable.

In Canada, sales tax is comprised of both a Federal and Provincial component. So depending on the ERP system, the same setup as explained above could apply, except regions would be Federal + Provincial/Territorial level, just federal (if provincial sales tax doesn't apply), just provincial for each province/territory (if federal sales tax doesn't apply).

Taxes applied by Cost Code

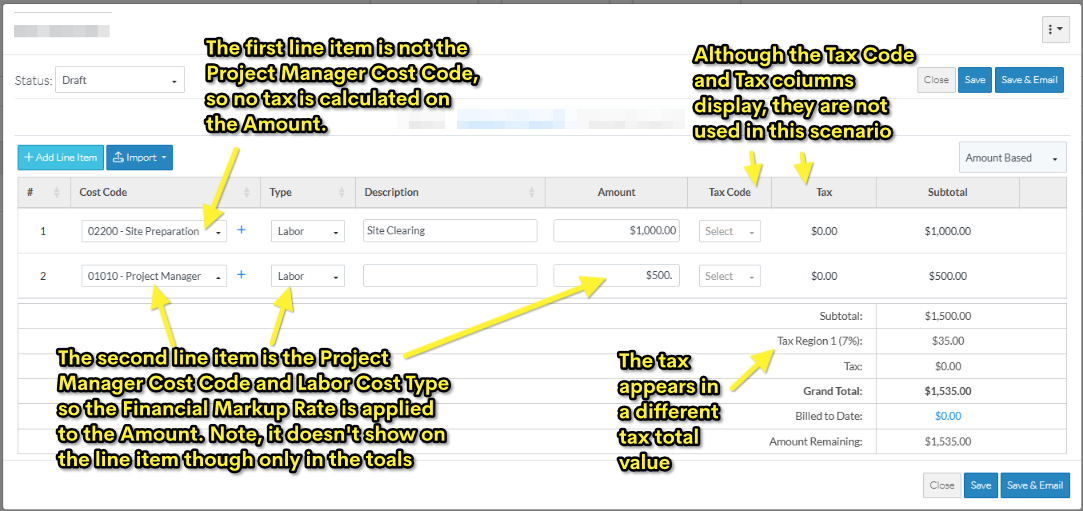

The second scenario is applying taxes based on the Cost Code.

This scenario uses the Financial Markup function that is setup for a Schedule of Values.

Taxes setup this way enable a tax rate to apply but works differently than the tax codes described above:

- It is applied automatically to all line items - there is no ability for it to be changed during the entry/revision of individual Line Items (where as tax codes as described above are manually selected to apply during entry)

- It can be set to apply to only certain Cost Codes or Cost Types (where as tax codes as described above are not related to Cost Codes or Cost Types, they are manually selected during entry to apply or not)

It does take more work to setup taxes by cost code but then the taxes are preset and does not require the tax to be determined during the line item entry. This reduces errors and data entry time for line items, as these are setup once and applied automatically to all items.

In the following example, a Financial Markup has been created that applies to Project Manager Cost Code and Labor Cost Type line items only:

So the Tax Value is calculated on line item 2 only ($500 x 7%=$35).

This value doesn't display on the line item, it only displays in a total.

In the example, the global list of Tax Codes is turned on, so it still displays but it not being used. It could still be used to support further tax scenarios, or it can be turned off so these two columns don't display at all nor in the total. The decision to use the global tax codes should be made prior to utilizing job costing as once they are turned on, they can not be turned off.

Next Steps

To use Global Tax Codes and manually set them on a Line Item basis, see Settings - Tax Codes.

To setup taxes for each individual Schedule of Values and to automatically apply on Line Items, see Financial Markup.